IPO IN REVIEW: SENHENG

By the time you read this, you have probably heard of the upcoming Senheng IPO.

There is no doubt that almost everyone here knows Senheng, the biggest electric and electronics (E&E) retailer in Malaysia. Before we dive further, let’s take a brief look at the company’s background:

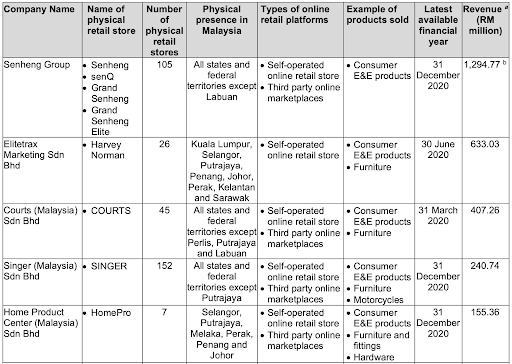

- Biggest E&E retailer in Malaysia by revenue. It recorded sales of RM1.29 billion for FY20 (FY19: RM1.144b, FY18: RM1.172b). For context, the closest contender is Harvey Norman, having posted RM633 million revenue for FYE June 2020.

- Operates 105 physical stores as of 30 Nov 2021, with plans to expand and increase the number of stores within 3 years to 156, particularly Grand Senheng Elite and Grand Senheng.

- Senheng carries with it about 10,000 store-keeping units (SKUs) from more than 280 brands.

- Its loyalty membership programme, PlusOne has over 3.24 million members with about 2.94 million signed up for a paid membership tier (with sales contribution of about 94% - 97% of its annual revenue for FY18 - FY20).

- Founders Lim Kim Heng (Chairman) and Lim Kim Chieng (Executive Director) have led the company since 1989 with decades of experience in the retail space.

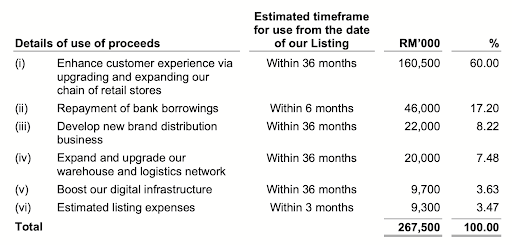

Senheng’s IPO price at RM1.07 represents an implied price-to-earnings (“P/E”) multiple of 28.8x based on FY2020 PATAMI (pre-money valuation). The company plans to raise RM267.5 million from the exercise, with RM160.5 million (60%) slated for upgrading and expanding its physical stores and RM46 million (17.20%) to be utilized for debt repayments. Meanwhile, about RM9.7 million (3.63%) will be used to boost its digital infrastructures.

Source: Prospectus

We believe everyone may have seen the prospectus, or at least have seen the summarised factsheet of the IPO. This writing will not focus on what has been written in those factsheets, but rather the customer’s experience, in terms of both customer service and product pricing.

For avoidance of doubt (and simplicity), let’s define customer experience here as the customer’s in-store purchase journey when buying a particular product.

To be fair, the business model of Senheng is relatively straightforward and simple, it resells electric and electronics products at fixed margins. But wait, does that mean the barrier to entry is low? Short answer is yes. Almost anyone could replicate the business model - in fact we have several other brands that do what Senheng does (with a few exceptions in terms of product offerings). For a start, some of us may have heard or seen All IT, BEST, HomePro, Harvey Norman, Singer, and many others.

Source: Prospectus

Customer Service: We visited a mall recently (during weekdays) to see if Senheng really does offer an exceptional customer experience, and if it has a competitive advantage as compared to its competitor’s stores.

First stop: SenQ

There weren’t that many customers that we could see at first glance. As we walked around the store, there were relatively a lot of products being displayed, indicating a wide range of product offerings by SenQ.

For those that did not have any specific product in mind, having all these varieties of choices is probably a plus point. We immediately went to the TV sections, and asked for a sales representative to help with our enquiries. It took around 2 minutes and 17 seconds for the sales representatives to come over and attend to us. Our queries were well addressed and we were satisfied with the explanations and the suggestions provided.

Second stop: BEST

Similar to SenQ, there weren't that many customers in the store as well. In terms of product offerings, we thought BEST had a relatively good variety of choices on display too. For an average customer, it was probably very decent.

Once again, we applied the same modus operandi. We went to the TV sections and requested a sales representative. It took them 2 minutes and 7 seconds to get someone to assist us. In terms of product knowledge, we found that the sales representatives from both BEST and SenQ were quite similar (or at least they could provide decent responses for typical questions from an average consumer)

Third stop: ALL IT Hypermarket

All IT is slightly different from BEST and SenQ in the sense that it does not have as many product offerings. However we were greeted with warm smiles and welcoming gestures as we entered the store. Knowing that its focus is more geared towards PC/Laptops, we asked for a sales representative to assist us with our queries in choosing a laptop. To our surprise, they were quite responsive. It took them around 16.71 seconds to actually attend to us.

We were satisfied with the services (or rather consultation?) when we were trying to decide which laptop is suitable for us.

Product Pricing: The percentage of households having access to the Internet has increased to 91.7% in 2020 from 90.1% in 2019*, and this has made online shopping easier than ever. With a few clicks or taps, one can quickly find the price of a 60” OLED TV without needing to step out from his/her bedroom. If a product (of the same brand and model) is priced cheaper in website A compared to website B, it is no brainer that one would buy from website A.

On that note, we made a quick comparison in terms of pricing of a few E&E products online. It comes to no surprise that Senheng’s prices are slightly in the premium range compared to some other online websites. (more details in Appendix A, B &C)

Pricing Comparison

| Senheng | Shopee | OneLiving | ESH | |

| Samsung UHD TV 85AU8000 | RM 10,799 | RM 9,599 | RM 9,999 | RM 10,288 |

| LG 8kg Inverter Washing Machine | RM 1,399 | RM 1,339 | RM 1,350 | RM 1,399 |

| Electrolux Dishwasher | RM 2,364 | RM 2,099 | RM 2,179 | RM 2,299 |

Source: Senheng, Shopee, OneLiving, ESH websites as at 9 Jan 2022

All else equal** and assuming rational markets, Senheng may eventually lose out to its competitors due to its premium pricing. Its premium pricing strategy may result in a future erosion of its earnings, considering the bulk of its revenue is derived from its PlusOne members. A competitor may replicate its membership strategy at a significantly lower price point.

We have no details on the PlusOne membership’s demographic data, but it is interesting to see how many of the members are aged between 20-45 and above 46.

Note:

*Source: DOSM

**Shipping costs and other potential rebates are not considered. Prices are taken at face value.

To sum it up…

We think it is quite obvious that Senheng is trying to position itself as the go-to brand when it comes to E&E products. However it is in our humble opinion that it is very difficult to see the one true key factor that differentiate Senheng from its competitors. Primary focus should be placed into enhancing its online store experience and ensuring cost reduction where necessary to achieve better margins, but we don’t see much of those in the pipeline, at least not for now.

Appendix A: LG 8kg Front Load Washer prices

Appendix B: Samsung 85” AU8000 UHD TV prices

Appendix C: Electrolux Dishwasher ESF6010BW

***********

Disclaimer: The information contained in this writing is prepared from data believed to be correct and reliable at the time of issue of this writing. KLSEJournal may or may not issue regular reports on the subject matter of this report at any frequency and may cease to do so or change the periodicity of reports at any time. KLSEJournal has no obligation to update this report in the event of a material change to the information contained in this report. KLSEJournal does not accept any obligation to (i) check or ensure that the contents of this report remain current, reliable or relevant, (ii) ensure that the content of this report constitutes all the information a prospective investor may require, (iii) ensure the adequacy, accuracy, completeness, reliability or fairness of any views, opinions and information, and accordingly, KLSEJournal, its affiliates and related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. In particular, KLSEJournal disclaims all responsibility and liability for the views and opinions set out in this report. KLSEJournal and its affiliates may or may not hold any interest, directly or indirectly in the securities aforementioned in this writing.